Industry Insights

Retail of Two Halves – How the Sports Goods Market is recovering from Coronavirus

Retail of Two Halves – How the Sports Goods Market is recovering from Coronavirus

Industry Insights

In a series of articles focused on the UK lockdown experience, Sports Marketing Surveys (SMS) has already explored the initial consumer response to the coronavirus crisis. Now, as the global situation evolves at different speeds in different places, and as businesses try to navigate that uncertainty, we look at the impact on retail of the coronavirus crisis. The questions that we will confront are fundamental to the survival, revival and resurrection of the sports industry. How severely were different sporting sectors impacted? What measures have helped avoid, minimise and alleviate the impact? What are the ongoing challenges and opportunities for different sports over the coming weeks, months and years?

In short, how will the Coronavirus pandemic reform and reframe the market for sports participation and sports goods?

Flying V

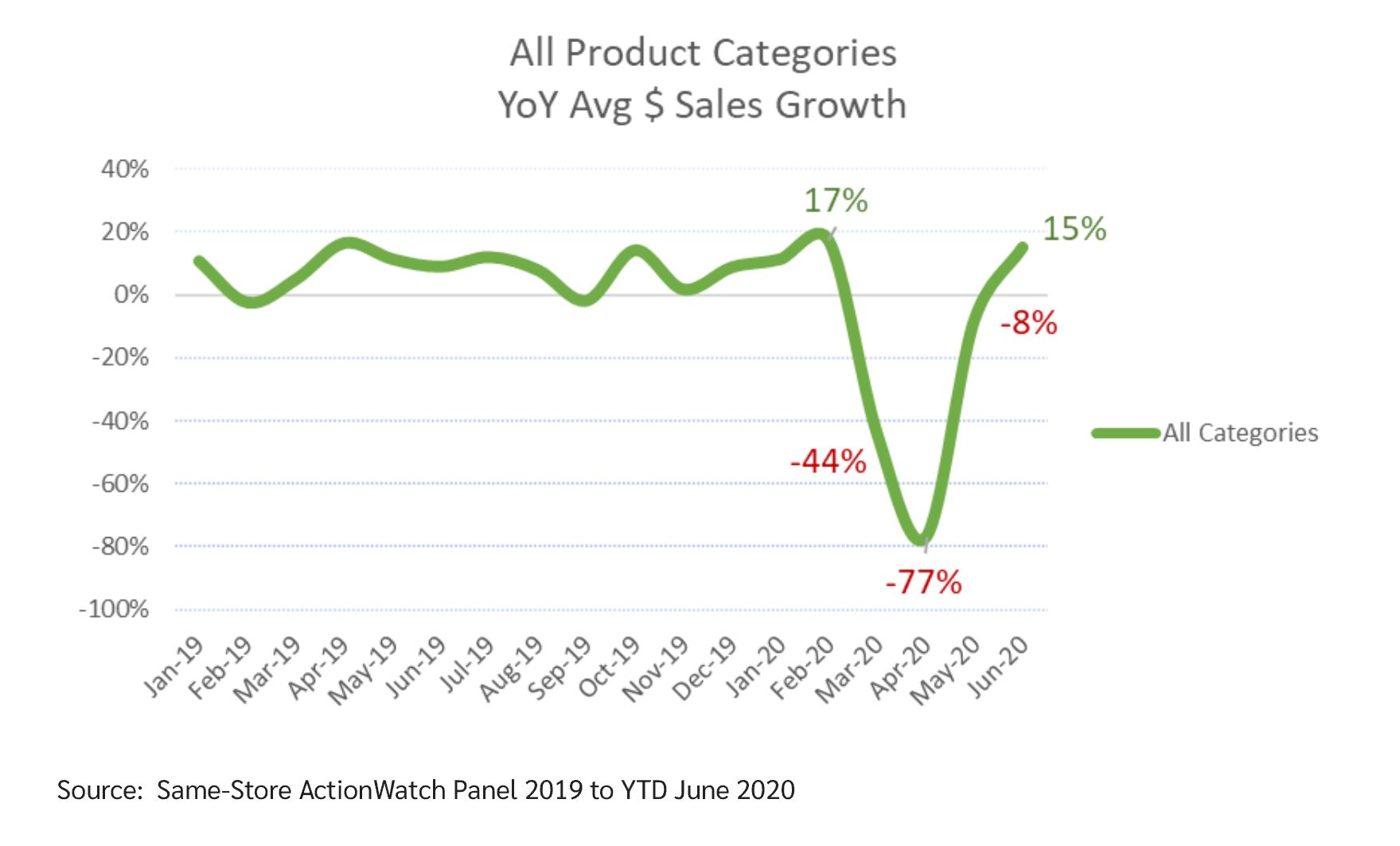

When we look at sales figures across a number of different sports, a clear and striking pattern starts to emerge. An initial, hard shock, followed by a swift, v-shaped recovery.

As the pandemic took hold, the immediate and unsurprising effect for most sports was of a very literal shock to the system. Some, like gyms, swimming pools, indoor sports, and even tennis, found themselves the wrong side of government guidelines and unable to open for bookings.

The inability to play sport then naturally translated into a lack of incentive to pay for sports equipment. As well as points of sale being closed, either because these are on shared sites with facilities, or because high street shops also closed, people also lacked confidence that they would be able to use any equipment they purchased.

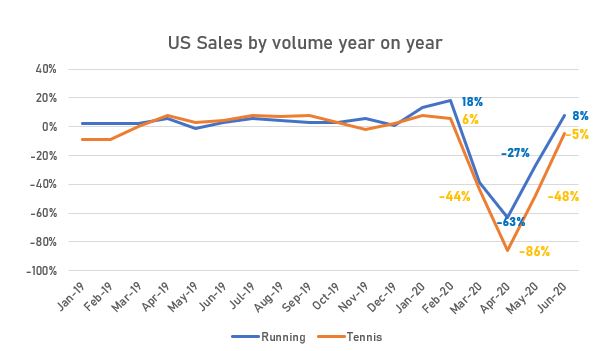

Looking at the TIA/SMS retail audit of the US pro/specialty tennis market, sales of racquets for example were 44% lower by volume year on year in March and 86% lower in April. In May, with 63% of US tennis businesses still closed, racquet sales were down 48%. Running shoes showed an almost identical trajectory, down 39% in March and 63% in April. (Source: SMS USA retail audits in the Running and Tennis industries)

However, as soon as guidelines began to loosen and facilities were able to reopen, the direction of travel reversed. In tennis racquets, June returned to near 2019 levels by volume. In running, unit sales were 8% higher than in the same period in 2019.

What can we learn from these figures? Firstly, it is interesting that running initially suffered the same adverse trajectory as tennis, even though, since it does not require facilities and is easy to achieve alongside social distancing, it was among the more Covid friendly sports. Retail closures, as much as, if not more so than facility closures, seem to have hit the sports goods industry, with many still reluctant to purchase often expensive products online.

On the other hand, where running has an advantage compared to tennis for example is that products like shoes often have a limited duration or mileage, and so sales may have been postponed rather than entirely lost. They could even, if personal mileage and engagement grows with leisure time, increase further in the future. The 8% rise in sales for June may be an early indicator of this.

What’s also interesting is that these figures show a rebound that may be outstripping projections from those closest to the coal face. A June survey run by SMS on behalf of the SFIA revealed that 72% of US sports businesses did not expect to return to pre-Covid sales levels until 2021 or later. In May the figure was 60%. In other words, although many businesses anticipated a further slide, the June tide seems to have shifted quicker and more dramatically than many in the US anticipated.

Inventory – A note of caution

While the trajectory of the recovery in Surf / Skate, Tennis and Running is hugely welcome and encouraging, we must be careful about assuming that this means the industries are in excellent health. To do so would be to undermine genuine ongoing concern.

For one thing, the downward arc of the curve came at perhaps the worst point of the calendar for most sports. Spring and early summer represent hugely important periods for sales, coinciding as they do with new product releases, major professional events that generate interest, and school, university and club fixture lists. Tangible growth will be required to offset the impact of a lost April and May.

We must also be careful not to equate volume with value. A surge in volume sales could easily mask a stagnation or decline in value sales if that surge is made up of new participants purchasing entry level equipment. Equally, there is danger in equating value sales with margin for brands and retailers. In the Surf and Skate industry for example, the 15% growth in June sales means the situation is less precarious rather than entirely resolved, since those sales were mostly driven by the least profitable categories, hardgoods. In surf hardgoods for example the average retailer margin is 36%.

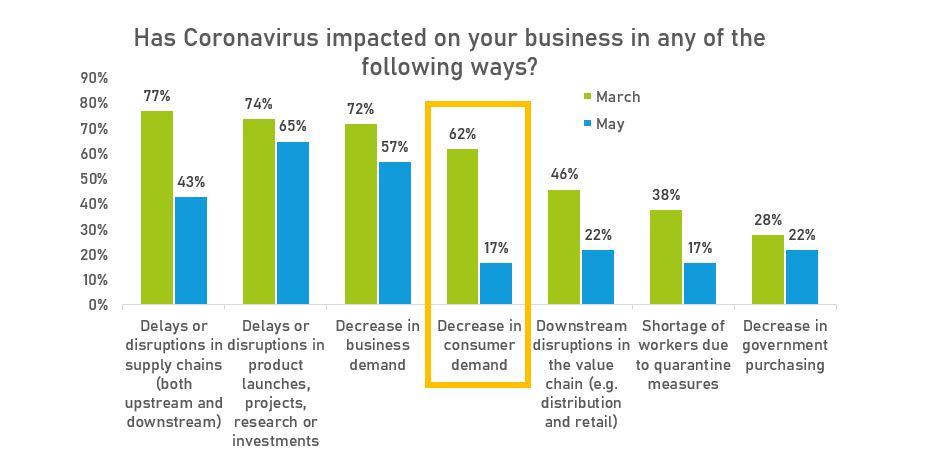

Economics relies on demand as well as supply so it would be remiss not to mention the supply contraction that has had and will continue to impact the sports industry. Coronavirus meant that factories that were forced to close temporarily; key staff were absent; businesses juggled competing pressures. Each of these factors came to play a part in affecting the supply chain. This was true regardless of whether the industry did face a constriction in demand. When SMS surveyed the European cycling industry on behalf of Cycling Industries Europe in March, the single greatest worry, cited by 77% of respondents, was delays to the supply chain, both upstream and downstream, making this a greater concern at the time than consumer demand (62%). With many of the parts that filter into the cycling industry made and assembled in China, this was a particular concern. When we asked the same question in May, concern about consumer demand had dropped to 17%, but fears about supply chains remained, if not as prevalent, then still apparent, with 43% of businesses citing this. Even where supply chains have been restored, delays to product launches, and research and development were a concern to 65% of businesses.

With supply impacted, new products delayed and demand restored it is not surprising that a second threat now looms on the horizon – inventory. Already reports from the cycling industry are indicating concerns about stock levels on both sides of the Atlantic. Even in the more heavily affected Surf / Skate industry, retailer fears have migrated from a shared fear of being over-inventoried to a concern about meeting demand. In this, flexibility on the part of brands was vital to helping retailers manage inventory, a phenomenon that a European Outdoor Group (EOG) and SMS survey of the outdoor industry also identified.

The sports industry of the future.

What does all this mean for the future of the sports industry? As always, this is likely to continue to affect different industries disproportionately. Sports like golf, running and especially cycling will likely find that they are faced with many more opportunities than difficulties. The latter, in particular has an opportunity to achieve once in a generation growth. We have discussed the reasons for this at length, but the raw facts also bear repeating. In the UK, where The Bicycle Association’s Market Data Service, powered by SMS, tracks sales and stock data for over 70% of the market in terms sales value, revenue in bikes, parts and accessories and services for the three months between April and June rose by a combined 63%.

What’s more, as the return to work gets underway, the suspicion is that the growth will continue. 7% of those commuting to work in the UK in the first week of August did so by bike, a figure comparable with the top end of estimates for before the lockdown, and this before the majority of office based white collar jobs which attract a number of cycling and multi-modal commuters, have returned to cities.

Cycling is the outlier in the sporting world, and for most, the trajectory, at best, will be more similar to the v-shaped recovery experienced by running, tennis and surf / skate.

Others may have to work even harder. Indoor sports and team sports in particular will have to do more to overcome issues around consumer confidence and depleted avenues to play. Tennis has already turned its focus to this. In the US, TIA and SMS research has shown that 78% of tennis businesses are introducing more frequent sanitisation in an effort to strike exactly this chord. 77% of facilities are also reducing group lesson sizes to help manage concerns over social distancing.

Most affected of all are likely to be those areas of the industry that are most reliant on travel and socialising. Sports tourism businesses for example will likely need to adapt and pivot to survive, either turning their focus to domestic tourism (not always easy if the price points exclude local customers) or else rethink their business models, since the appetite for travel is likely to be suppressed in the long term. Modelling from The International Air Transport Association (IATA) for example suggests that global air traffic will not return to pre-Pandemic levels until 2024.

Despite these threats, at an overall level, the changes to work, socialising and sport provide at least as many opportunities as they do challenges. If Covid-19 does lead to more widespread home working, tens or hundreds of millions of people around the world will suddenly find themselves with more useable time. If governments get serious about encouraging exercise, and invest in active travel and social prescription, as the British Government announced in July, sports can and will benefit.

A beginning not an end

That is not to say that initial investments already announced as part of the pandemic recovery should represent an end point. Quite the opposite. Investments like the British Government’s £2n in active travel or the over 2,300km of bike lines installed across the EU between March and August should be a first step, with giant leaps still to come. Research programmes like economic impact monitors can be an important method of substantiating the gains caused by investment in activity and exercise, and building a case for matching or growing funding going forwards. They will be needed, because as the pressure on public finances grows, arguments for investment will grow more competitive. Federations and businesses must come together as the time has never been riper for a radical rethink of how we prioritise sport, exercise and fitness.

After all, if governments can subsidise petrol costs as an important contributor to physical and social mobility, can they not also subsidise e-bikes? If data proves that sport can ease the burden on healthcare providers and compliment traditional healthcare, does it not make economic, as well as social sense, for governments to subsidise tennis racquets, golf clubs, running shoes and surfboards?

Sport is often talked about as life in microcosm, a training ground for the values and skills that can accompany people as they make their way through the world, but it is time to start talking about it as so much more than that. Sports Marketing Surveys strongly believes that sport has a role to play not just in imagining, but in actively building active, healthy and happy nations.

To discuss how your sport, event, facility or club can build a case for growth and investment, please contact info@sportsmarketingsurveys.com

When we look at sales figures across a number of different sports, a clear and striking pattern starts to emerge. An initial, hard shock, followed by a swift, v-shaped recovery.

More News Articles

More News Articles

Looking for extensive insight and strategic solutions for your organisation? We can help.